AI Stock Bets: Millennial Money Moves That Are Actually Kinda Genius

Photo by Zulfugar Karimov on Unsplash

Silicon Valley’s latest investment trend is making waves, and it’s not another crypto scam - it’s AI-powered stock picking. Young professionals are turning to chatbots like ChatGPT to craft investment strategies that might just outsmart traditional wealth management.

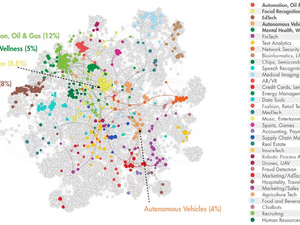

Daniel Padilla, a San Francisco finance grad, decided to put AI to the test by asking chatbots to design a stock portfolio that could potentially survive the impending white-collar job apocalypse. After some “bullying” (his words, not ours), he convinced Perplexity and ChatGPT to generate detailed investment recommendations.

The AI Investment Experiment

His experimental portfolios are turning heads, with returns that would make most financial advisors sweat. Padilla’s Perplexity portfolio is up 49% since March, while his ChatGPT portfolio hit 52% - significantly outpacing the S&P 500’s modest 22% rise.

The Risky Business of AI Financial Advice

But before you dump your life savings into an AI-recommended portfolio, experts are waving some serious red flags. UC Berkeley’s Yaniv Konchitchki warns that without a unique information edge, AI is essentially “repackaging the consensus” - which could lead to synchronized investor behavior and potential market volatility.

The Human Element

Despite the exciting returns, both Padilla and tech startup founder Harpaul Sambhi view these AI investment experiments as curiosity-driven hobbies, not retirement strategies. As Padilla candidly admits, “If the AI bubble pops, these portfolios are going to get absolutely decimated”.

So, fellow Bay Area risk-takers: proceed with caution, keep most of your money in boring index funds, and maybe treat AI stock picking like that weird craft beer experiment - fun to try, but not something to bet your entire future on.

AUTHOR: mls

SOURCE: SF Standard