Silicon Valley's Dirty Little Secret: How One VC Firm Got Caught Playing Footsie with Putin's Oligarchs

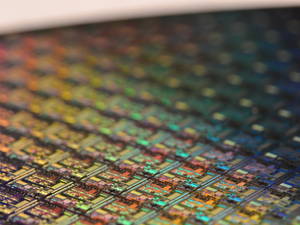

Photo by Greg Bulla on Unsplash

Talk about a tech world scandal that’ll make your startup-loving heart skip a beat. A San Francisco venture capital firm just got absolutely wrecked by the U.S. government for some seriously shady international money moves.

GVA Capital, a Bay Area VC firm, just got slapped with a jaw-dropping $215 million fine for managing investments for a sanctioned Russian oligarch named Suleiman Kerimov. Because apparently, international sanctions are more like suggestions in the world of tech funding.

From Startup Dreams to Geopolitical Nightmares

Kerimov, a Putin ally worth an estimated $16.4 billion, used GVA Capital to funnel millions into the Bay Area’s tech scene throughout the 2010s. The firm, which once bragged about not being “your daddy’s typical VC firm,” was basically running an international money laundering masterclass.

The Oligarch’s Silicon Valley Playground

Through an elaborate web of shell companies, GVA Capital distributed $28 million of Kerimov’s funds into everything from self-driving car tech to a converted church turned startup incubator. Because nothing says “innovative tech ecosystem” like Russian oligarch money, right?

The Consequences of Playing Fast and Loose

After being sanctioned in 2018 for the Kremlin’s “malign activity,” Kerimov’s assets were frozen. But GVA Capital apparently didn’t get the memo, continuing to manage his investments through his nephew. The result? A massive fine that’ll make even the most hardened venture capitalist wince.

Moral of the story? In Silicon Valley, global politics and tech funding are closer dance partners than you might think.

AUTHOR: cgp

SOURCE: SF Standard