Wall Street Stumbles: Trump's Trade Shenanigans Leave Markets on Edge

Photo by Maxim Hopman on Unsplash

Wall Street experienced a glorious morning of confusion, inching upward just like your Monday motivation aspirations. As geopolitical issues and President Trump’s mind-boggling trade policies hung over the market like a foggy San Francisco morning, anxiety was at an all-time high.

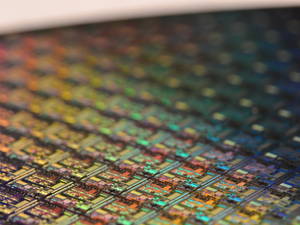

In a scene reminiscent of last month’s attempt to assemble IKEA furniture, futures looked almost unchanged, with the S&P 500 and Dow Jones Industrial Average pretending everything was fine, while the Nasdaq took a modest dip of 0.3%. The cause? Rumors swirl around tightened U.S. trade restrictions targeting China’s semiconductor sector, causing tech stocks to act as jumpy as a cat on a hot tin roof.

Let’s not forget how Trump has made friends with geopolitical chaos, dividing U.S. relations with European allies faster than our morning coffee can turn cold. With his lukewarm support for blaming Russia for the invasion of Ukraine, the president is turning that political teapot on its head. Nothing says diplomacy like a one-man show letting tariffs take the lead.

Trump recently escalated his tariff game, claiming that hikes on imports from our neighbors, Canada and Mexico, were back on track after a mini-pause. Plus, he’s throwing an additional 10% tariff at China, stirring the pot by citing their role in producing all things evil, particularly the opioid crisis. Who needs an economy when you can create chaos?

Financial analysts aren’t holding back, Stephen Innes of SPI Asset Management stated, “President Trump isn’t blinking on tariffs. Uncertainty reigns, and economic momentum is sputtering”. So, like a bad reality show, the plot thickens, and we’re all left waiting for the next twist.

Major corporations are just as lost as the rest of us, warning about the cloudy outlook of U.S. trade policies. The University of Michigan’s consumer sentiment index sank roughly 10% over the past month due to fears about tariffs and that inconvenient truth called inflation.

In the stock exchange drama, Home Depot was the unwelcome guest, dropping 2% after unmet expectations, even though they technically crushed sales and profit forecasts. Bitcoin didn’t escape the turmoil either, dropping another 3% to a disheartening low. Because who needs stability in this economy?

Across the globe, European markets showed some mixed results while Asia bore the brunt of the unrest, with Tokyo and Hong Kong seeing declines. Because it’s not just America that’s on this rollercoaster ride.

So here we are, stuck in this financial thriller with no credits rolling anytime soon. Stay tuned for the next episode!

AUTHOR: mpp

SOURCE: AP News