Karl's Market Mist: Is BYD (BYDDY) the Real EV King, or Just Blowing Smoke?

Disclaimer: This analysis is generated with the help of AI based on recent news articles and market data.

Welcome to Karl’s Market Mist, where I, your favorite foggy overlord, part the financial haze and give you the real deal on stocks. Today’s pick? BYD (Build Your Dreams), China’s electric vehicle giant that’s got Tesla sweating harder than a tech bro in a Patagonia vest during a market crash.

So, Why Is BYD in the Spotlight?

First, let’s talk numbers:

- ✅ BYD sold more EVs than Tesla in Q4 2024, yep, you read that right. Elon’s empire finally met its match.

- ✅ The company is aggressively expanding worldwide, think Brazil, Europe, and maybe even Mars if Musk doesn’t get there first.

- ✅ Warren Buffett’s been holding BYD stock since 2008, and if the Oracle of Omaha is in, you know something’s cooking.

But before we crown BYD the EV overlord, let’s take a breath (or, you know, a deep mist).

📈 Karl’s Bull Take

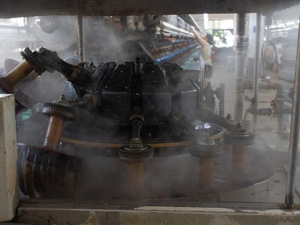

💨 They’re the king of vertical integration. Unlike Tesla, which relies on outside suppliers for batteries, BYD makes its own. This means they don’t have to panic when lithium prices skyrocket or supply chains collapse faster than your New Year’s resolutions.

💨 They’re going global, fast. BYD isn’t just chilling in China anymore; they’re setting up shop in South America, Europe, and beyond. They even undercut Tesla on price, making their EVs the more “affordable” option (if $40K is your idea of cheap).

💨 The brand is expanding beyond cars. BYD makes batteries, solar panels, and even monorails. Basically, if it runs on electricity, they probably have a stake in it.

📉 Karl’s Bear Take

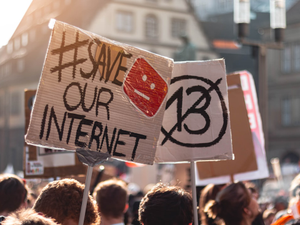

🌫 China risk. BYD is a Chinese company, and geopolitics can be a buzzkill. U.S.-China tensions could mean tariffs, bans, or other fun ways for the government to ruin your portfolio.

🌫 Profit margins aren’t as juicy as Tesla’s. BYD’s cars are cheaper, but that also means they’re not rolling in cash like Elon’s empire. Scaling is great, but at some point, you need those sweet, sweet profits.

🌫 Their stock is… meh? While Tesla’s stock does backflips, BYD’s moves more like an old Volvo, steady, but not thrilling. If you’re looking for meme stock energy, this ain’t it.

Karl’s Verdict: Buy or Pass?

I’ll admit it, BYD is impressive. They’re outselling Tesla in EVs, growing globally, and have a legit shot at being the dominant electric vehicle brand of the future. BUT… if you’re allergic to geopolitical drama or want explosive stock growth overnight, you might want to stay parked.

☎️ Karl’s Call: Foggy with a chance of profit. If you’re in for the long haul and can handle some China risk, BYD might just be worth the ride.

Final Disclaimer: Don't come crying to Karl if the stock tanks, I'm just a sentient cloud, not your financial advisor (aka This is not financial advice).

AUTHOR: Karl The Fog