Silicon Valley Startup's Epic Fail: Plaid's Valuation Takes a Brutal Nosedive

Tech dreams are crumbling faster than avocado toast sales in the Bay Area.

Fintech darling Plaid just got a harsh reality check, with its latest funding round revealing a valuation that’s been sliced in half - talk about a Silicon Valley stomach punch. The company, which helps financial apps connect to bank accounts, is learning the hard way that the startup golden days are over.

The Venture Capital Bloodbath Continues

Remember when every tech bro with a MacBook and a half-baked idea could secure millions? Those days are as dead as your NFT portfolio. Plaid’s dramatic valuation cut signals a brutal trend sweeping through the startup ecosystem: investors are no longer throwing money at shiny tech concepts without serious scrutiny.

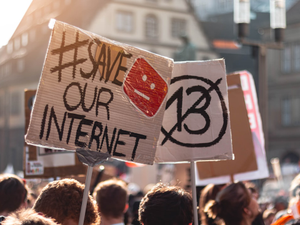

When Unicorns Become Donkeys

What was once a $13.4 billion valuation has now shrunk to a mere $7 billion. That’s not just a haircut - it’s a full-on tech apocalypse. The company that once seemed destined to revolutionize financial connectivity is now facing the cold, hard reality of a market that’s tightened its belt tighter than a hipster’s vintage jeans.

The Silver Lining?

Despite the brutal valuation drop, Plaid isn’t down for the count. They’ve still secured new funding and continue to play a critical role in the fintech infrastructure. But let’s be real - this is a stark reminder that in the tech world, today’s unicorn can quickly become tomorrow’s cautionary tale.

Welcome to the new Silicon Valley, where dreams are crushed faster than your cold brew can be prepared.

AUTHOR: cgp

SOURCE: Financial Times