Tech Startups Are About to Get Absolutely Wrecked by Trump's Tariff Madness

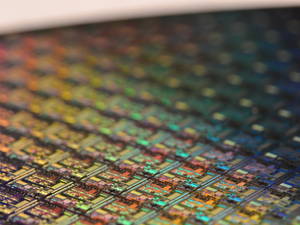

Photo by Igor Omilaev on Unsplash

Silicon Valley is bracing for economic turbulence as President Trump’s chaotic tariff policies threaten to send venture capital markets into a tailspin. Startup founders and investors are now playing a high-stakes game of economic roulette, with hardware companies looking particularly vulnerable.

The tech ecosystem is experiencing serious tremors as investors scramble to understand the potential fallout. Venture capitalists are now reconsidering their investment strategies, with many distancing themselves from hardware startups and exploring alternative funding mechanisms.

The Tariff Tornado

Investment firms are warning founders to close ongoing funding rounds immediately and be extremely judicious about capital deployment. Charles Hudson from Precursor Ventures noted the unpredictability, stating that the “logic for tariffs seems to reside only in the president’s head”.

A Silver Lining?

Despite the gloomy forecast, some sectors might emerge relatively unscathed. Defense tech, AI, and logistics startups specializing in nearshoring could potentially benefit from these geopolitical shifts.

The Secondary Market Savior

With traditional IPO pathways looking increasingly complicated, venture capitalists are pivoting towards secondary market sales as their primary liquidity strategy. Investors are adapting quickly, transforming from long-term “HODLers” to more strategic sellers.

As the tech world holds its breath, one thing remains certain: unpredictability is the only predictable element in this economic rollercoaster.

AUTHOR: cgp

SOURCE: Wired