Wall Street's Roller Coaster: Inflation Data Rises But Trade War Throws Punches

Photo by Aditya Vyas on Unsplash

U.S. stock indexes took a brief breather from their usual angst Wednesday, inching upwards thanks to some inflation news that wasn’t entirely dreadful. In layman’s terms: It’s not all doom and gloom… at least for a hot minute.

The S&P 500 decided to play the rebel and gained a cool 0.5% after riding a cringe-worthy wave of ups and downs that left investors feeling like they’ve been on a date with an indecisive Tinder match. Seriously, it swung from a promising 1.3% gain to a borderline identity crisis by day’s end.

Meanwhile, the Dow Jones Industrial Average juggled gains and losses like a circus act, dropping 82 points despite bouncing from a 287 point gain to a 423 point loss. The Nasdaq composite, however, decided to show it was the star of the show by climbing 1.2%.

Why the optimism, you ask? An inflation report that showed prices rose less than the doom-mongers in economics had predicted. Welcome back, artificial intelligence stocks! They surged as U.S. consumers collectively sighed in relief. Companies like Nvidia even saw a glorious 6.4% increase, though they still have to reckon with a 13.8% loss for the year thus far. But hey, it’s progress!

Elon Musk’s Tesla threw in a surprise performance, rocketing up by 7.6% for its first back-to-back gain in nearly a month. Talk about a comeback kid!

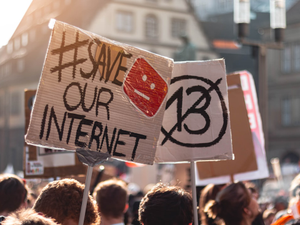

But hold your applause. Not every star shone bright. The dark cloud of Trump’s trade war is still lurking, and stocks are feeling the brunt. Big names like Brown-Forman (5.1% drop) and Harley-Davidson (5.7% plunge) faced the music as the European Union retaliated against U.S. tariffs on steel and aluminum, because why not?

And while Donald Trump waxes poetic about bringing back U.S. manufacturing jobs, it seems he also enjoys stirring up a cocktail of confusion among Wall Street. With every tariff threat and then a sudden walk-back, consumer confidence is sinking, prompting many to tighten their belts.

In short, the stock market may be riding the waves of uncertainty, but like any good Millennial or Gen Z-er knows, staying afloat in turbulent times takes more than just a smooth ride, it requires a caffeine-fueled, snack-infused strategy.

Let’s keep that critical spirit alive, folks. Tariffs are taxes, and they’re just bad news for everyone involved.

AUTHOR: tgc

SOURCE: AP News