Wall Street's Meltdown: When the Rich Get Nervous, We All Pay the Price

Photo by Aditya Vyas on Unsplash

Stock market aficionados, gather 'round, because Wall Street is experiencing quite the existential crisis. In a not-so-surprising twist, the cacophony of economic worries and presidential tweets has sent the stock market tumbling down faster than a tech bro’s self-esteem during a startup pitch.

On Monday, the S&P 500 dropped 1.4% in early trading, marking another day in the life of Wall Street’s rollercoaster. The Dow Jones Industrial Average shed nearly 430 points, or 1%, and the Nasdaq composite faltered 2.1%. It’s like a reality TV show, but instead of drama and romance, we’re getting a crash course in economic anxiety.

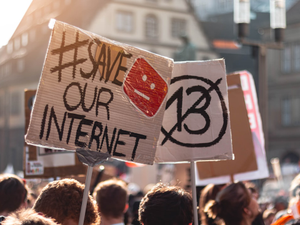

What’s the culprit this time? Surprise, surprise: it’s those tariffs from President Trump that everyone loves to talk (or complain) about. Yes, the same tariffs that economists warned might send shockwaves through the economy and have people clutching their wallets tighter than a college student on a ramen budget. The S&P 500 is now lounging down 7.4% from its February high, meaning the rich might need to swap their champagne bubbles for something cheaper.

In a weekend debate with Fox News, Trump tiptoed around the R-word, recession. He mentioned, “It takes a little time,” which sounds vaguely reminiscent of the excuses we hear from our favorite non-committal exes. Meanwhile, Commerce Secretary Howard Lutnick casually announced the implementation of 25% tariffs on steel and aluminum, as if it’s just another day in the office.

Despite all this, the job market is hanging in there, with stable hiring rates still puffing out some optimistic smoke signals. But hold on to your hats, folks, because economists are slashing their growth forecasts, with one from Goldman Sachs predicting just 1.7% growth for 2025. A one-in-five chance of recession? Just the thing to keep you up at night!

Of course, it’s not just big companies that feel the heat. Tech stocks, once the fashionable darlings of Wall Street, are falling faster than a fad diet. Nvidia, which just a year ago enjoyed an 820% stock surge, recently reported an 18.3% decline this year alone. Apple, currently mired in its own delays, saw its stock dip 3.2%. Meanwhile, Bitcoin’s value is falling back toward $83,000, proving that even cryptocurrencies are not immune to the whims of the oligarchs.

In response to this economic theater, investors are rushing toward safer options. U.S. Treasury bonds are suddenly looking more attractive, with prices rising and yields falling.

As for the international scene, European indexes are also sliding, reflecting the global unease. Hong Kong’s market plunged 1.8% while Shanghai saw a slight drop. China reported its first decline in consumer prices in over a year, adding to the narrative of a worldwide economic downturn.

So, dear readers, stay tuned! Just as Wall Street recovers, it seems another twist is waiting.

Let’s reduce those tariffs already, or we might just find ourselves sharing that ramen budget sooner than expected.

AUTHOR: mpp

SOURCE: AP News