Cannabis Cash Crunch: How Newsom Just Saved Cali's Weed Industry from Total Burnout

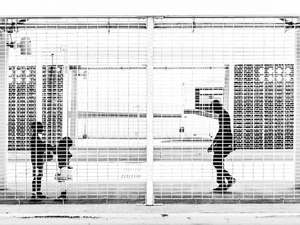

Photo by Thomas Hawk | License

California’s legal marijuana scene just got a much-needed lifeline, and it’s not your typical green relief. Governor Gavin Newsom signed a bill that’s basically throwing a financial joint to struggling cannabis businesses by temporarily rolling back the excise tax.

The Tax Break Breakdown

Imagine trying to compete with the black market while being taxed to death - that’s been the reality for legal cannabis operators. The new law suspends a planned tax hike, keeping the excise tax at 15% instead of jumping to 19%. It’s like a financial breather for an industry that’s been gasping for economic oxygen.

Why the Black Market is Winning

Let’s be real: legal weed sales have been struggling. Currently, only about 40% of cannabis consumption is through legal channels. Farmers have flooded the market, prices have dropped, and the illegal market keeps laughing all the way to the bank. This tax suspension is basically Sacramento’s attempt to level the playing field.

The Nonprofit Pushback

Not everyone’s celebrating, though. Some environmental and social service nonprofits are crying foul, arguing that this tax rollback means less funding for critical programs like child care and substance abuse services. Alicia Hamann from Friends of the Eel River called it a “stab in the back,” highlighting the complex ecosystem of cannabis economics.

Whether this tax break will be the magic joint that sparks the legal cannabis industry’s revival remains to be seen. But one thing’s certain: in the Bay Area’s complex relationship with weed, nothing is ever simple.

AUTHOR: cgp

SOURCE: CalMatters