Silicon Valley's Biotech Darling Crashes: How Synthego Went from Hero to Zero

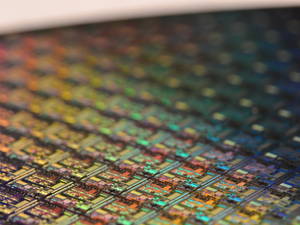

Photo by Greg Bulla on Unsplash

In the glittering world of Bay Area biotech, another startup bites the dust. Synthego, once a golden child of gene editing technology, has filed for bankruptcy, proving that even the most well-funded tech dreams can turn into expensive nightmares.

Founded by two ex-SpaceX employees, Synthego rode the CRISPR wave with ambitious plans to revolutionize genetic research. Their pitch was simple: make complex gene editing tools accessible and user-friendly. Between 2012 and 2022, they managed to rake in a jaw-dropping $392 million in equity financing - no small feat in the cutthroat startup ecosystem.

The Rise and Spectacular Fall

Despite rapid revenue growth from 2020 to 2023, Synthego couldn’t outrun its mounting debt. The company’s chief restructuring officer, Allen Soong, admitted that even after slashing costs by a third, they couldn’t generate enough cash flow to service their debt obligations.

The Bailout Plan

In a last-ditch effort to save face, Synthego is prepared to sell its entire business to Perceptive Advisors, a biotech-focused hedge fund. CEO Craig Christianson remains optimistically delusional, claiming there’s “tremendous opportunity” ahead. Classic startup spin?

The Bottom Line

With assets estimated between $50-100 million and liabilities ranging from $100-500 million, Synthego’s bankruptcy is a stark reminder that in the tech world, today’s unicorn can quickly become tomorrow’s cautionary tale. Another day, another Silicon Valley dream crushed under the weight of venture capital expectations.

AUTHOR: tgc

SOURCE: SF Gate